Shala understands just how difficult it could be to hold onto an automible. Expanding right up in the South California, she had recollections away from family car journeys so you can Disneyland, Las vegas, as well as the beach. I’d an amazing upbringing up until I became 17, she says. Following that, that which you ran downhill.

For the 2001, Shala’s mother broke their unique ankle. After, she set up a blood embolism and you can died out of the blue. Shala was just for the cusp out of adulthood; their unique mother was thirty-five. They strike us very hard, Shala claims. Two months later on, Shala along with her sisters moved across the country with regards to stepdad, to Virginia are closer to their friends. Shala battled together with her despair. By the 17, she are expecting with her very first child.

She stayed in Roanoke just after highschool, raising their particular child and working, and also by 31, she was a mother or father from a couple of used by a big insurance coverage agency. She hated just how her works influenced the amount of time she is actually in a position to invest along with her pupils, and felt that around just weren’t a beneficial possibilities to possess their in the event the she lived in Virginia. She wanted returning to California and you will as time goes by carrying out her own organization. So she produced contact with her physical dad, who was simply still-living in California. The guy available to assist their look for a career and you can a location to live on when the she showed up home.

New county’s Tips Auto loan program will bring affordable, low-focus auto loans so you’re able to certified users in the CalWORKs, a california public direction system

Shala got brand new Chevrolet Impala she’d already Read Full Article been settling and drove it out of Roanoke to help you Hillcrest throughout a weekend. When she had around, she noticed that her father was not indeed in a position to let. Basic, he set their own upwards at home off a close relative whom was not able to complement their along with her child. After that, the guy paid for every night inside a hotel room where the door don’t secure and you can everything try thus dirty one to Shala failed to need certainly to lay down for the sleep. Their own diyah, up coming eight yrs . old, try together with her during the time (their son existed with his dad from inside the Virginia). Each of them thought very afraid of becoming the evening which they fled the space and slept in their automobile.

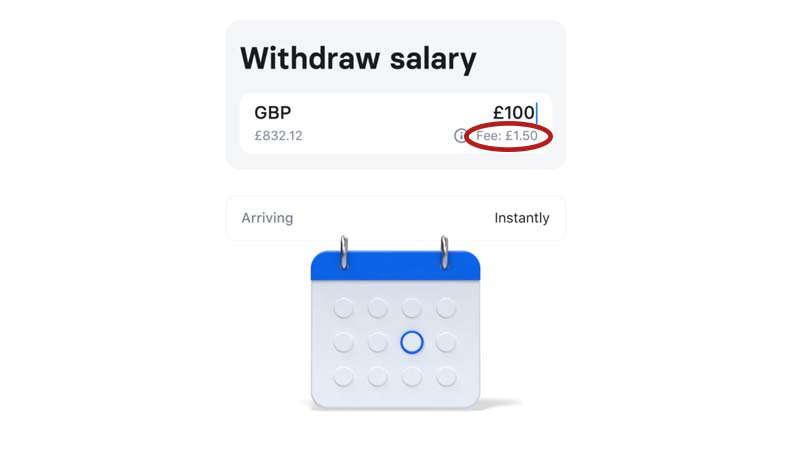

Tips or any other financing programs can help people who you are going to if you don’t be susceptible to predatory loan providers pushing business they know readers can’t manage to spend

Immediately after a few weeks, Shala got work and you can protected a flat. It didn’t have one chairs, therefore each night Shala expensive a dual-size of mattress getting their and you may Damiyah to sleep to your. Was it had been apartment, she says. She generated omelets for every single break fast, trying keep grocery will set you back lower and you may conserve as much as she could.

When you’re she was incapable of go back on her behalf base, she dropped at the rear of into payments to your Impala. In the near future, she already been worrying that it might be repossessed. She resided right up late at night, hearing the musical away from visitors, dreading a pull truck do started and take the car. One-night, it is actually new truck, she states, beginning to cry at the thoughts. It got my vehicle, and that i are on it’s own. I did not keeps some body. I found myself particularly, just what will i do?

Getting an auto is a fantastic step into freedom, but it’s not the last step. We must do better as the a people to provide an excellent finest standard of living, says Marla Stuart, manager of your own Contra Costa Condition A career and you may Peoples Properties Agencies.

However they plus help address new inequity individuals face on the fresh new field. Fraction applicants, according to browse by the Southern area Methodist College or university teacher Erik Mayer and you may associates, are step 1.5 payment situations less inclined to rating financing compared to the its light peers, despite factoring within the earnings and you will credit scores. 7 per cent Apr higher than similar light customers. Minorities is actually managed because if the credit history is roughly 31 activities lower than it really is. But when we see default pricing towards the automotive loans, we do not see people facts this particular is justified in economic terminology, Mayer informs Vox.