Share This information:

California Senate Expenses 978 (the brand new Bill) became rules on . Even with more 3 years as the enactment, we we talk to fail to know its wide-ranging implications particularly when it comes to changes in framework credit. The bill written numerous the newest areas to help you Ca Company & Procedures Password, for instance the creation of Point 10232.step three (B&P 10232.3). Exactly what had previously been constraints and therefore only placed on multibeneficiary loans turned into a beneficial blanket laws for everyone funds establish of the registered Ca agents (Brokers).

B&P 10232.3 basic lies the actual restrict Loan-to-Well worth (LTV) limitations and this need to be followed for all funds install by Brokers, broken down from the sort of guarantee and kind of occupancy once the taken to from the table below:

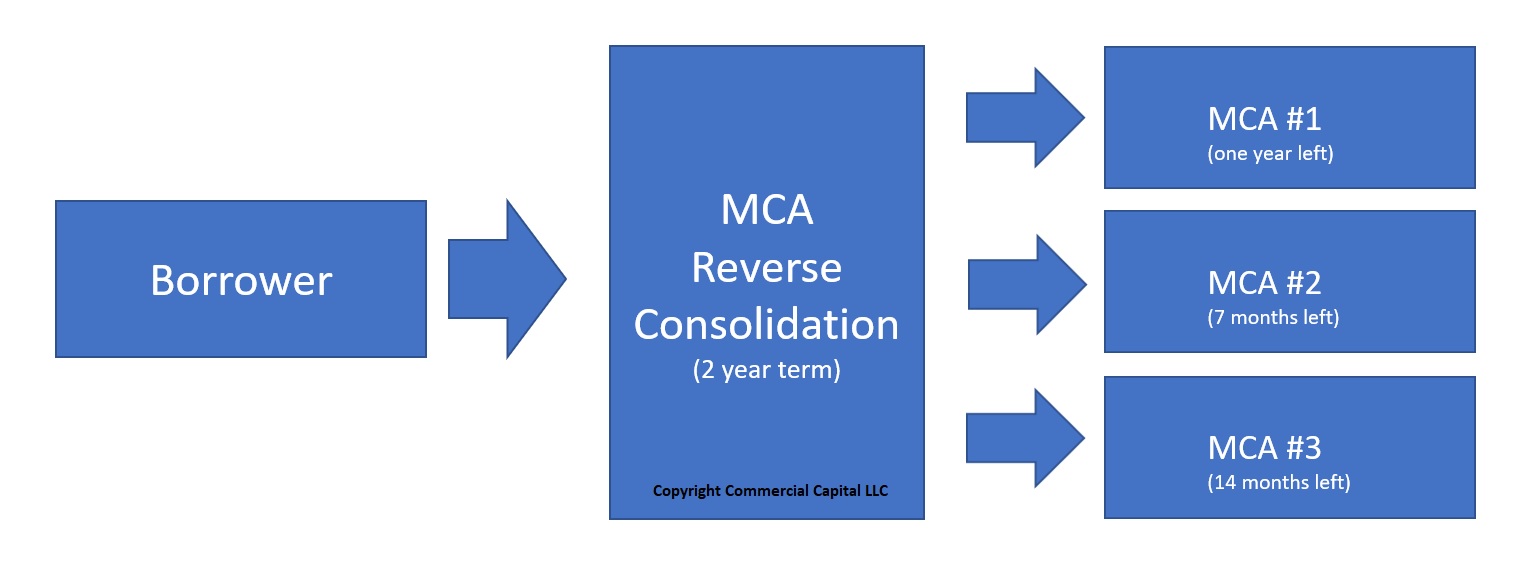

The brand new LTV determination is founded on the present day Market price out-of the true possessions guarantee, also referred to as the fresh new as-was worthy of. not, because so many framework lenders understand, basing LTV off of the because the-try really worth usually far is higher than the LTV restrictions proscribed significantly more than. It is because brand new Borrower’s intended advancements would be to drastically help the LTV, and you will a high amount borrowed is necessary to create the individuals designed developments. The house or property really worth determined article improvements is sometimes referred to as this new Once Fixed Worth (ARV). To deal with this matter, SB 978 looked for to add a construction enabling Agents to set up mortgage purchases where in fact the LTV limits made use of ARV versus the fresh new as-was value.

B&P 10232.2 particularly relates to funds in which the Lender is not disbursing every financing fund straight to Borrower from the loan closing, and also the Agent need trust brand new ARV of the home to slip below the limit LTV limits over. The constraints is broken down anywhere between money in which there was a good holdback more than $100,000 and you will fund containing a beneficial holdback out of $100,000 or less. The rules is explained lower than.

step 1. The borrowed funds need to be fully funded, towards the whole amount borrowed placed with the an enthusiastic escrow membership prior to recording the newest action of trust.

Because of this people charges on the mortgage, for instance the construction holdback, can not be internet funded. The financial institution ought to provide the full loan amount in order to escrow, and then people activities otherwise holdback amounts is delivered back to your Bank after tape.

2. An extensive, detailed mark plan have to be incorporated to help you guarantee quick and right disbursements to complete the project.

This is really important as the draw schedule have a tendency to definition both for Lender and you may Borrower how disbursements might possibly be created from new holdback number. By providing an in depth mark schedule in the closure, any issues along side technique of disbursements was handled before the mortgage is actually financed. It will bring both sides towards the safeguards regarding once you understand there would-be enough financing to accomplish the project, and that discover reveal bundle in place getting winning best cash advance in FL.

step three. An authorized appraiser have to done an appraisal.

Commonly considered one of the greater amount of cumbersome conditions, this new Representative don’t trust a BPO or any other valuation. The fresh new individual need receive the valuation off an authorized appraiser into the conformity with Consistent Requirements out-of Top-notch Assessment Routine (USPAP). Of many members see which requirement particular onerous inside the purchases that have to romantic rapidly, however, as opposed to almost every other areas of the newest password there is absolutely no difference provided right here.

cuatro. The loan data need certainly to details the actions that can easily be taken when your project is not accomplished, whether or not due to lack regarding loan continues, standard, or other reasons.

Normally, the construction holdback language in the mortgage data commonly identify just what comes if you have a meeting out-of standard or another matter occurs that needs the lending company to take action to protect the fresh new financial support.

5. The borrowed funds amount will most likely not exceed $2,500,.

Customers are often astonished to hear there is people limit on the aggregate amount borrowed. A broker may do an initial and you will next loan bifurcating the brand new purchase loans and you can buildings financing provided the fresh new ARV LTV cannot meet or exceed limitation restrictions offered over toward structure loan.

Financing which include a housing holdback greater than $100,000 and you will Agent was depending on ARV.

Also the four conditions specified over, in case the structure venture boasts good holdback number of over $100,, the fresh broker get rely on ARV to determine the limitation LTV in the event that a few most (and you may onerous) defense try came across:

1. A separate, basic, third-class escrow holder is employed for everyone dumps and you will disbursements relating towards framework otherwise rehab of your secure assets.

Usually an extremely contentious procedure having people whom possibly have to retain power over the development finance to possess noticeable factors, or alternatively really wants to secure the added desire get back toward non-paid finance, B&P 10232.step 3 necessitates the finance as paid of the a simple 3rd cluster escrow owner given that a spending budget handle agent.

2. The fresh disbursement draws from the escrow account are derived from verification from a different accredited person that certifies that works accomplished at this point matches this new relevant rules and conditions hence the new pulls have been made in accordance with the framework offer and you can mark plan.

An independent Qualified Body is identified as a person who is not a worker, broker, otherwise affiliate of agent and you can that is a licensed designer, general builder, structural professional, otherwise effective local government building inspector acting in his or her certified capacity.

Many of our website subscribers keep up with the functions from a homes administration organization that will see each other conditions above, because they are licensed due to the fact contractors and as an enthusiastic escrow team.

Ultimately, B&P 10232.3 evenly is applicable maximum funding limitations having buyers of the limiting resource in almost any one to mortgage so you’re able to just about 10% regarding an enthusiastic investor’s web worthy of (exclusive away from home, household, and you will autos), or a keen investor’s adjusted gross income. It code, like limit LTV limits, try strictly limited to multiple-beneficiary loans prior to the enactment away from SB 978, now relates to all the money set up by Agents. Unsure if for example the structure loan files are SB 978 compliant? Contact us below.