Everything Would like to know Before you can Borrow Family Equity

Thus you’re interested in borrowing from the bank house security, but you possess a lot of concerns. What kinds of prices should i anticipate? What style of charges do i need to be cautious about? Do you know the conditions?

Luckily, we are able to answer many of these questions and provide you with a beneficial obvious thought of exactly what brand of choice you might select from so you’re able to select the greatest home guarantee mortgage that fits your position. Folks wants to get the most bang for their buck, so let’s view exactly what version of facts your should know in terms of good HELOC.

What exactly is My personal Rate?

Short Answer: A beneficial borrower’s price is founded on the newest borrower’s credit rating and you can the latest shared loan-to-worth (CLTV) of topic assets. HFCU’s HELOC rate set within duration of closure is actually associated with the newest WSJ Prime Rates which is examined month-to-month. The fresh new HEL rates is fixed on name of the mortgage.

A few things determine the pace you only pay for a beneficial HELOC. First thing you may have zero control of. The next thing, you have got overall control over.

- The prime Price: Our very own rate is dependant on the WSJ Best Price. We comment it month-to-month and usually set it up at first of your own few days. WSJ signifies the latest Wall surface Road Record. For each and every weekday, this newsprint surveys at the very least 70% of your 29 largest finance companies and you will posts the brand new consensus best speed. The WSJ Finest Price are the most used as “official” supply of the top rate. You’ve got zero control of it speed you could display screen they with a watch on the providing financing in the event that rate try off. If you’re looking for a personal line of credit, the rate have a tendency to vary.

- Your credit rating: This aspect of deciding their HELOC speed is a thing that you has done control of. The better their borrowing from the bank, the lower the rate you will pay. The fresh cost you will find stated at any financial institution usually have a footnote you to definitely checks out something like: “Prices found is actually to own people into ideal credit character. Other cost are available, according to your credit history. Call us for price information.”

Also a tiny boost in your credit score can save you a lot of money along the lifetime of a loan. Very, while you are hunting cost, take time to review your credit history and rating. If you are not sure ways to get or see their borrowing from the bank rating, you might sign up for a totally free credit history remark . Our very own professionals often color code your credit report to you and take you step-by-step through how exactly to discover and you may understand it.

Can you use an appraisal getting property Collateral Loan?

When we discover a credit card applicatoin to have property security mortgage otherwise HELOC, we need to dictate the benefits into the assets. Which, consequently, lets us influence the quantity which is often lent. Yet not many times with the financing, an entire assessment is not needed. Listed here is as to the reasons.

I’ve enough info that will give us a keen exact valuation off a home. You’re an automated valuation in line with the research concerning your home maintained public records. Some days, a straightforward drive by off an enthusiastic appraiser usually suffice. As long as people checklist studies on your home is right, these types of appraisals are perfect.

How come We are in need of a beneficial Valuation otherwise Assessment to possess HELOCs?

A real house appraiser interprets the business to estimate an excellent property’s worth. The purpose of an enthusiastic appraiser will be to supply a sensible view about good property’s real well worth at the time of the newest assessment. Appraisers amass studies about the web site of the home in addition to balance of society, amenities such unique kitchens otherwise showers, and also the shape of the home. Appraisers are apt to have a house or financing feel and you will, for the majority says, is subscribed.

The newest assessment covers the debtor in addition to financial.Through getting an exact worth of the brand new guarantee at home, it covers you from credit too-much contrary to the worth of our home and you will risking entering economic difficulties. They on the other hand protects this new membership of your borrowing from the bank commitment of financing you also far contrary to the value of the home.

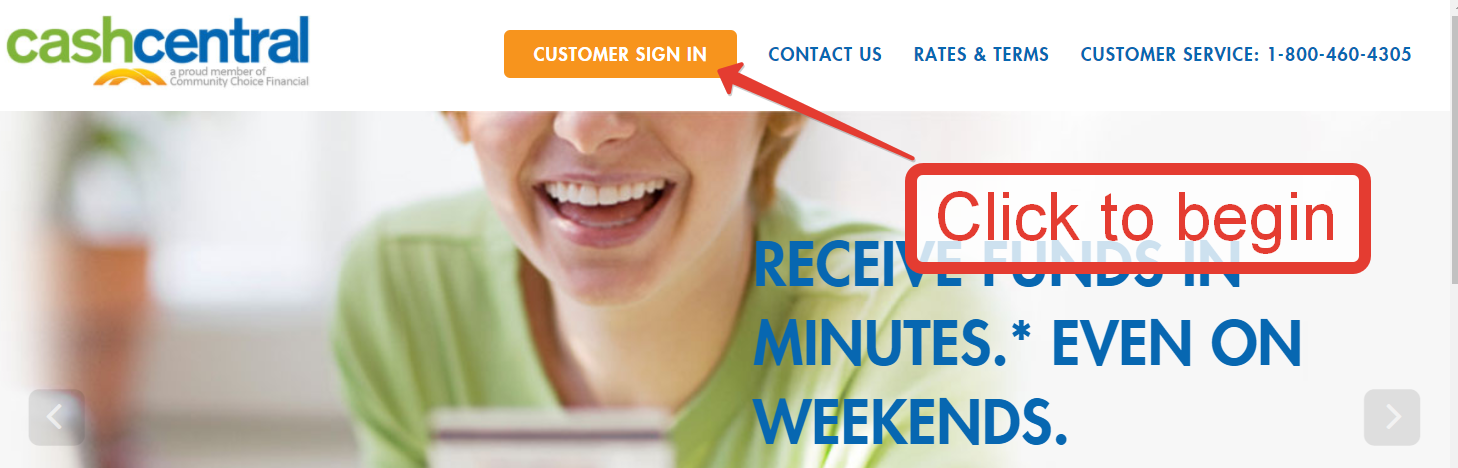

You can buy a projected property value your house here. Enter in the home target from the appropriate field and click Fill in. You are going to quickly discovered a projected well worth variety toward assets.

How to Calculate the possibility Guarantee of your home

Deduct this new a good balance in your mortgage off 75 % of the worth of your house so you’re able to calculate your possible distinctive line of credit otherwise financial matter.