https://cashadvancecompass.com/loans/signature-installment-loans/

CHFA as well as necessitates that you are taking a house consumer education class. Groups come online and from inside the-individual. CHFA advises using classification early using your home research so your happy to to track down a lender and you can a residential property representative who are the best fit for you.

Because we talked about, certain software keeps low-down fee conditions to possess very first time family consumers. But many ones programs come with an additional month-to-month prices called personal financial insurance coverage (PMI). PMI is actually an insurance policy you have to buy (at the own expenses) which covers the financial institution should you become defaulting into your financial.

PMI is usually required by the bank for those who set quicker than simply good 20% downpayment on your family. The price of PMI can be between 0.5% and you may step 1% of your own total amount borrowed. So it results in $step 1,000 a-year for each and every $100,000 lent. To put it differently, if you are taking out a great $2 hundred,000 financial, you can are obligated to pay an additional $166 payment per month for PMI.

The newest Federal People Shelter Operate offers the right to query a loan provider to get rid of PMI after you have about 20% home equity. This implies you possess 20% of your property both while the you have repaid that much, or since business works for you and you will escalates the full worth of your residence.

Government Applications to possess Basic-Go out Homebuyers

Government financial software give another option to own very first time home buyers inside Tx. Including, while not able to meet up with the borrowing criteria of the local county apps, a national program might provide a lot more freedom. Here are some alternatives that are appealing to very first time home buyers while they take on lowest fico scores and gives off fee guidance.

FHA financing: An enthusiastic FHA mortgage is a good solution when you yourself have a great low credit history. A credit history off 580 or higher could possibly get will let you lay out only 3% with the a property pick. A credit score lower than 580 needs good 10% advance payment.

Virtual assistant financing: Va fund try attractive because they don’t wanted a down payment, and you may credit rating conditions try flexible. You must be involved in the armed forces, an experienced, otherwise a qualifying mate to utilize this choice. On the other hand, no PMI will become necessary because of it program.

USDA loans: USDA funds are available to accredited borrowers to shop for in certain geographical portion. Which usually is sold with outlying section that have communities away from below 20,000. There is no deposit criteria, but the debtor demands a credit history away from 640 or higher.

Undertaking a healthier Financial Upcoming

Due to the fact a first and initial time home customer inside the Texas, you have access to unique apps that other buyers are unable to accessibility. is right for the state was your own choices, however it begins with inquiring a few pre-determined questions: The amount of money would you be able to establish on home pick? What is actually your credit rating? Exactly how much might you afford to pay monthly?

We understand the main points can seem to be daunting, but the look you’re performing right now is the perfect first action! The greater amount of you are aware concerning the options available together with most useful you realize the to find power and you will limits the higher standing you’ll end up into secure down your ideal house.

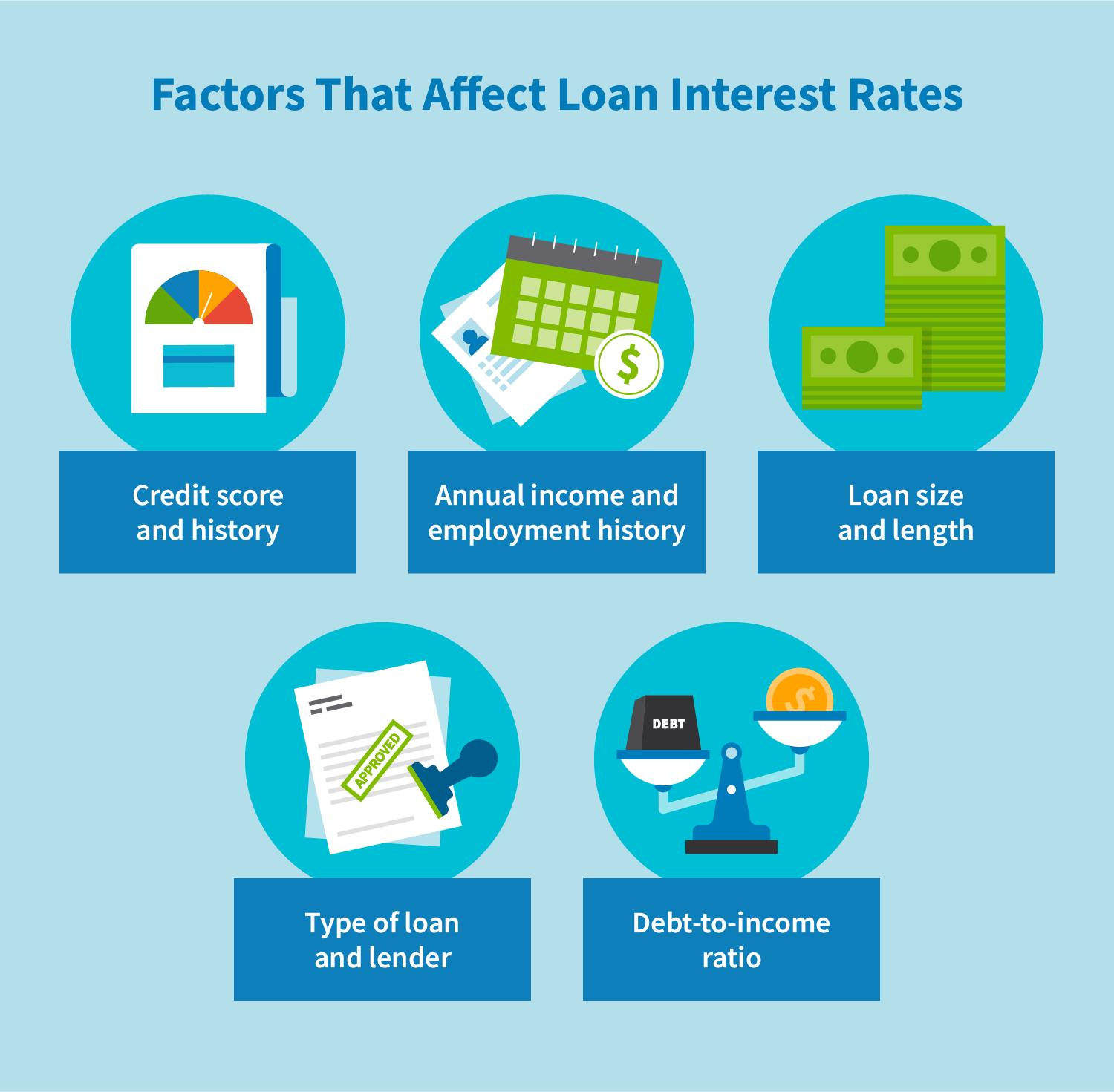

Really loan providers play with an obligations-to-money ratio plus don’t such as this proportion to help you meet or exceed 43%, according to the program. Such, can you imagine that you entice a gross income regarding $4,000 month-to-month (extent just before fees otherwise deductions is actually removed). The overall amount of personal debt, including the mortgage, bank card repayments, and you will auto costs is $step 1,750. Separate your debt because of the earnings and you also get an effective DTI proportion out-of 43%. In this case, in case your debt happens people highest, you’ll likely have trouble qualifying into CHFA system.